In einem kürzlich in Paris, SEC -Vorsitzenden Paul Atkins, versicherten OECD -Soiree versicherten den versammelten Massen, dass „die meisten Krypto -Token keine Wertpapiere sind“, eine so aufschlussreiche Erklärung wie eine Motte, die die Sonne beschreibt. Die Agentur, so behauptete er, tobt fleißig auf den Marktrichtlinien, obwohl man vermutet, dass ihre Feder in bürokratischem Honig getaucht werden.

Atkins betonte mit der Leidenschaft eines Mannes, der das Kreuzworträtselhinweis schließlich „Digital Assets“ beherrscht, seinen Fokus auf die Umgestaltung der Vorschriften für das Kapital auf Ketten. Er versprach die Klarheit für Investoren und die rechtliche Gewissheit für Unternehmer, während er die SEC aufforderte, ihre Vorliebe für die selektive Durchsetzung aufzugeben-eine Praxis, die so charmant ist wie ein Waschbär, der eine Bäckerei überprüft.

Atkins deutete auch auf eine „Super-App“ und eine Blockchain-Vision hin, die All-in-One-Kryptoprojekte validieren könnte, ein so revolutionäres Konzept, das darauf hindeutet, dass man in Einklang Socken und Sandalen tragen könnte.

Seine Rede, eine Meisterklasse im regulatorischen Optimismus, fiel mit dem Aufstieg von Bitcoin auf 114.233 US-Dollar zusammen, eine Zahl, die sich wundert, ob die Münze von einem zeitreisenden Warren Buffett heimlich finanziert wurde. Das Handelsvolumen stieg um 18%, und die Anleger strömten zu Bitcoin Hyper ($ hyper) , was 15 Millionen US -Dollar in einem so begeisterten Vorverkauf einbrachte, dass ein Risikokapitalgeber in ihren Grünkohl -Smoothie weinte.

Paul Atkins enthüllt bahnbrechende Krypto-regulatorische Vision

Atkins, der visionärste Bürokraten, betonte die Notwendigkeit von Klarheit und rechtlicher Gewissheit bei der Kapitalbeschaffung von Onketten. Der SEC, bestand er, müsse Transparenz und Konsistenz in den Regeln sicherstellen, eine so empfindliche Aufgabe, die wie eine Nadel während der Augen verbunden ist.

Project Crypto, ein Rahmen zur Modernisierung der Regulierung, war der Star der Show. Es ermöglicht Plattformen, Handel, Kredite und Steckdarsteller unter einer einzigen Lizenz anzubieten-ein bürokratisches Wunder, das der Suche nach einem vierblättrigen Klee auf einem Parkplatz ähnelt.

Dieser Rahmen, so Atkins, könnte Krypto „Super-Apps“ geboren und dienste unter einer Schnittstelle konsolidieren. Eine mutige Vision, obwohl man argumentieren könnte, es geht weniger um Innovation als vielmehr darum, den Benutzern einen weiteren Grund zu geben, auf ihre Telefone zu starren.

Atkins also praised Europe’s MiCA framework, a regulatory move as transformative as the invention of the wheel. He waxed poetic about AI and blockchain integration, a next-gen solution that could lower costs and expand access to trading tools. A utopian ideal, perhaps, but one that makes as much sense as a vegan steakhouse.

The new policy, a shift from aggressive enforcement to a more flexible approach, positions the U.S. as a crypto leader. A title once held by the moon, now passed to the SEC in a bureaucratic relay race.

Atkins‘ Crypto Shake-Up-Here’s How Investors Stand to Win

With Atkins‘ policies, investors and users are said to benefit. Clarity and legal certainty, he argued, are catalysts for token growth and financial apps. A claim as bold as suggesting that coffee is essential to productivity.

The Clarity Act and SEC-CFTC cooperation agreement are steps in the right direction, a phrase as hollow as a man’s promises after a night of drinking.

Atkins‘ policy shift, he claimed, would make crypto markets more accessible, transparent, and safe for retail investors. A promise as reliable as a weather forecast in Texas.

And best of all, we could get new crypto ETFs and hybrid portfolios (Bitcoin/gold), which let you diversify without navigating unregulated platforms. A solution as elegant as a toaster oven that also brews tea.

Regulatory clarity, Atkins argued, will encourage whales and retail investors to move capital into Layer-2 projects like Bitcoin Hyper. A claim as audacious as suggesting that a goldfish could win a Nobel Prize.

SEC’s Atkins Sparks Market Optimism-Is Bitcoin Hyper the Next Big Thing In Crypto?

Built on a Bitcoin Layer 2 via the Solana Virtual Machine (SVM) and the Canonical Bridge, Bitcoin Hyper ($HYPER) enables ultra-fast, low-cost contract execution without compromising Bitcoin’s security. A feat as impressive as a magician pulling a rabbit from a hat made of blockchain.

The industry will finally have dApps, smart contracts, and DeFi features on Bitcoin’s ageing chain! A statement as optimistic as a snowball in July.

The token supports lending, borrowing, and liquidity farming on partner platforms, with optional token burns that boost scarcity and value. A strategy as subtle as a megaphone whisper.

The presale has raised over $15M, a figure that makes one wonder if the SEC is now in the business of funding moonshots. Participation is still open, though the window is as narrow as a camel through the eye of a needle.

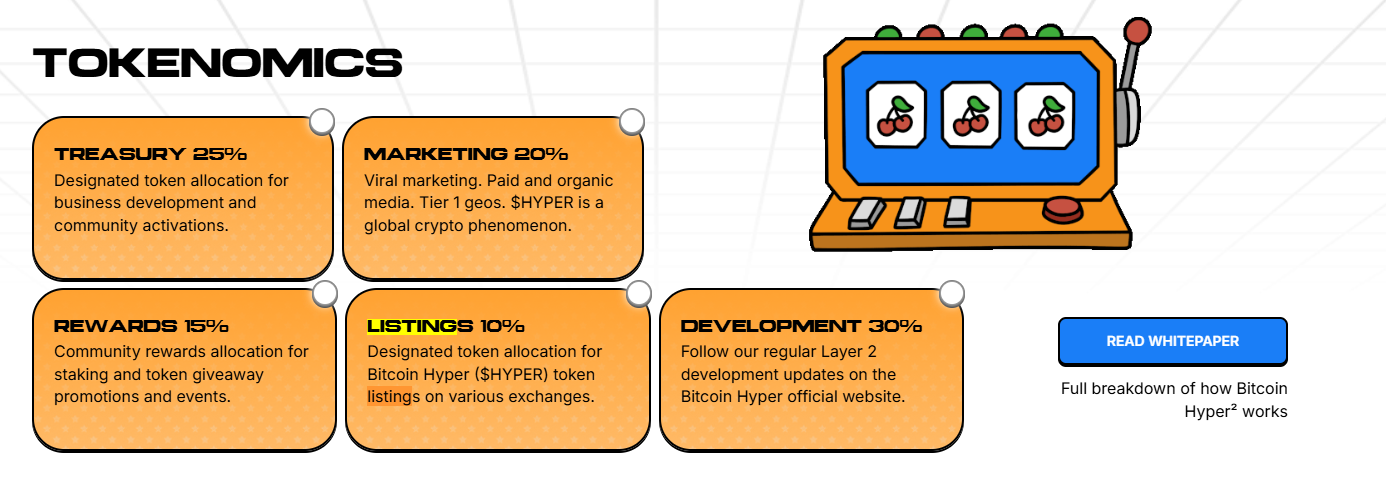

With a fixed supply of 21B tokens, $HYPER reserves 15% for rewards, including staking incentives. The staking program offers a 74% APY, a number so high it could make a venture capitalist faint.

Additionally, 30% of tokens are allocated to Layer 2 development, a commitment as strong as a man’s loyalty after a divorce.

Recent whale buys of $161.3K and $100.6K show big-money confidence. A confidence as misplaced as a man betting his house on a coin flip.

Analysts predict $HYPER could reach $0.02595 by 2025 and $0.253 by 2030. A forecast as reliable as a psychic predicting the lottery numbers.

Read more about the Bitcoin Hyper price prediction 2025 – 2030 here.

Takeaway: Clear Rules and Market Optimism Make Bitcoin Hyper a Token to Watch

Paul Atkins‘ push for clarity has reinstated confidence in Bitcoin-based projects like Bitcoin Hyper. The new framework aims to protect investors while opening doors to innovation. A balance as delicate as a tightrope walker on a trampoline.

Atkins‘ policies have elevated $HYPER’s potential to „exponential growth.“ With strategic developments and adoption, the $15M raise sets the stage for a crypto coup. A coup as dramatic as a man trying to eat a whole pizza in one bite.

Bitcoin Hyper ($HYPER)

Cryptocurrency tokens are highly speculative and volatile. Always do your own research (DYOR) before investing. A reminder as useful as a weather forecast for a desert.

Weiterlesen

- Snoop Dogg schlägt Gold: $ 12 Millionen verkauft blitzschnell! Kannst du es glauben? 😂

- Bitcoin hat eine Party und alle sind eingeladen 🎉

- Finden Sie heraus, warum Chainlink der neue Liebling der Krypto -Welt ist! 💰🚀

- Ethena trotzt dem Krypto-Crash wie ein Betrunkener der Schwerkraft! 🚀

- 🚨XRPs letztes Roar? Wann zu retten, laut 🐃tony Severino🚨

- Solana gegen XRP: Der ultimative Showdown für Kryptoinvestoren im Jahr 2025

- Altcoins: Die große Flucht aus der Bärenfalle 🐻🚀

- Wird sich Bitcoin wie ein Phönix oder ein Felsen steigen? 🎢💸

- Könnte Zcash um 50 % abstürzen? Die Krypto-Horrorgeschichte 2025, mit der Sie nicht gerechnet haben! 💀

- Cryptos wilde Fahrt 🎢

2025-09-11 11:30